How do you know that you are financially fit. Many of us still don't understand or no idea at all why we need to be financially fit, maybe because its all about numbers and I am sure some of us are afraid or get intimidated on this. But lets think this, Lets stop our worries about this and I think this is the right time that each of us should be aware and financially fit, so that we can invest for a great future especially when we get retire.

CFA Institute is a champion for ethical behavior in investment markets and a respected source of knowledge in the global financial community. The CFA goal is to create an environment where investors’ interests come first, markets function at their best, and economies grow. They have created the “Essentials of a More Secure Retirement” to highlight key principles and practices that will help individual investors successfully reach their retirement goals. Using the tools, planning insights, and suggestions in the document will help you to Get Started, to Keep It Going, to Invest Wisely, and to eventually Retire Well.

Get Started If you've not yet initiated a savings program, start today - the hardest step is getting started. So, how to begin?

- Review your finances, and ensure that you can spend less than you earn.

- Create a budget that includes regular savings, and stick to it.

- Open a savings account at your bank or building society. This is the easiest way to start saving. Find out why it is important to save.

- Work toward having an emergency fund so that you can insulate yourself from having to tap into your retirement savings during an emergency.

- Set an automatic deduction for each paycheck to start building your savings. Even seemingly small contributions can be a great start because time works for you. Find out ways to get more from your paycheck.

Keep it Going The key to long-term success is establishing and then sticking to your savings plan. This is important for a more secure retirement. So, be disciplined and remember that your savings program is for your future.

- Each contribution will add up over time, so get started! There are important benefits to starting early and continuing to invest consistently.

- Seek financial advice from a trusted financial adviser where available. Financial professionals can help you understand your savings needs and design a savings plan appropriate for you. Understand your rights as a consumer of financial services by reviewing the Statement of Investor Rights.

- Save as much extra money as you can. When you have some money left at the end of the month or receive money you didn’t expect — perhaps a bonus or an inheritance — do something nice for yourself, but try to save the rest.

- Save regularly and strive to increase the amount you set aside each year.

- Understand more about the rules on how much to save and how to invest.

- Look at the balance between saving and reducing debt.

- A credentialed financial adviser can help you with this undertaking. Make sure that you and your adviser review your retirement needs and your investments regularly. One way to determine your future retirement needs is to find a retirement calculator that takes into account pension and retirement opportunities in your local area.

- Use a broadly diversified portfolio of global stocks and bonds. The mix of the amount of stocks versus bonds depends, in part, on your age (time to retirement) and your ability to tolerate market turbulence or risk.

- Seek low-expense products. Returns are only expected, but expenses are certain. Transaction costs and fees are your enemy because they reduce the amount you save. Be sure to implement your plan with low-cost funds, and be mindful of commissions, front-end loads, and other expenses. Learn more about the impact of fees on retirement savings.

- Consider the need for insurance, including health insurance, inexpensive life insurance, disability insurance, umbrella liability insurance, and low-cost annuities (PDF) where appropriate. A qualified adviser can assist with a plan designed for your needs.

Retire Well Your ability to achieve a secure retirement and live comfortably after your working years depends on how you get started, how you keep it going, and invest wisely. Why is this important?

A more secure retirement depends on:

- how long you are retired,

- how much you spend before and after retirement,

- how much you have saved, and

- how well you invest.

CFA Institute warns individual investors to be cautious of their investment decisions to avoid these seemingly simple yet impactful missteps.

1. No investment strategy

Every investor should form an investment strategy that serves as a framework to guide future decisions. A well-planned strategy takes into account several important factors, including time horizon, tolerance for risk, amount of investable assets, and planned future contributions.

2. Invest individual stocks instead of a diversified portfolio of securities

Investing in an individual stock increases risk versus investing in an already-diversified mutual fund or index fund. Investors should maintain a broadly diversified portfolio incorporating

different asset classes and investment styles. Failing to diversify leaves individuals vulnerable to fluctuations in a particular security or sector.

3. Investing in stocks instead of in companies

Investing is not gambling and shouldn’t be treated as a hit-or-miss proposition potential. Analyze the fundamentals of the company and industry, not day-to-day shifts in stock price.

4. Buying High

The fundamental principle of investing is buy low and sell high. Others at risk for “buying high” are those who follow investment fads, buying the “popular” stocks of the day. Typically, these investments become fashionable for brief periods, leading many to invest at the height of a cycle or trend-just in time to ride it downward.

5. Selling Low

The flip side of the buy-high-sell-low mistake can be just as costly. Keep in mind that not every investment will increase in value and that even professional investors have difficulty beating the S&P 500 index in a given year. Always have a stop-loss order on a stock. It’s far better to take the loss and redeploy the assets toward a more promising investment.

6. Churning your investments

Too-frequent trading cuts into investment returns more than anything else. A study by two professors at the University of California at Davis examined the stock portfolios. The study found that, without transaction costs, these investors received a 17.7% annualized return, which was 0.6% per year better than the stock market itself. But, after transaction costs were included, investors’ returns dropped to 15.3% per year, or 1.8% per year below the market. Again, the solution is a long-term buy-and-hold strategy, rather than an active trading approach.

7. Acting on “tips” and “soundbites”.

Listening to the media for their sole source of investment thinking rather than pursuing a professional relationship with an advisor is a far too common investor mistake. While breaking news and “insider tips” may seem like a promising way to give your portfolio a quick boost, always remember you are investing against professionals who have access to teams of research analysts.

8. Paying too much in fees and commissions

Incredibly, investors are often hard-pressed to cite specifics on the fee structure employed by their investment service provider, including management fees and transactions costs. Investors should, as a precondition to opening an account, make sure they are fully informed as to the associated expenses that accompany every potential investment decision.

9. Decision-making by tax avoidance

While individuals should be aware of the tax implications of their actions, the first objective should always be to make the fundamentally sound investment decision. Some investors, rather than pay a large capital gains tax, will allow the value of shares in a well-performing stock to grow so large it accounts for an inordinate percentage of their overall portfolio.

10. Unrealistic expectations

It is important to take a long-term view of investing and not allow external factors cloud actions and cause you to make a sudden and significant change in strategy. Comparing the performance of your portfolio with relevant benchmark indexes can help an individual develop realistic expectations.

11. Neglect

Individuals often fail to begin an investment program simply because they lack basic knowledge of where or how to start. Likewise, periods of inactivity are frequently the result of discouragement over previous investment losses or negative growth in the equities markets.

12. Not knowing your real tolerance for risk

Keep in mind that there is no such thing as risk-free investing. Determining your appetite for risk involves measuring the potential impact of a real dollar loss of assets on both your portfolio and your psyche. In general, individuals planning for long-term goals should be willing to assume more risk in exchange for the possibility of greater rewards. However, don’t wait until a sudden or near-term drop in the value of your assets to conduct an evaluation of your level of tolerance for risk.

As part CFA awareness and campaign to have a financially fit country, The Financial Fitness Run is a kick-off event in putting heightened level of awareness for the investors rights.

May 29, 2016

5K / 10K / 21K

Bonifacio Global City

REGISTRATION CATEGORIES & FEES:

5k -Php 550.00

10K -Php 650.00

21K -Php 850.00

Inclusive of running shirt, race bib, and timing cheap.

RUNNING GROUP REGISTRATION PROMO:

- 10% Discount for Running Group Registration (Minimum of 30 Runners)

- Logo inclusion in photowalls, race day video coverage, event day and pre event day publication materials

EARLY BIRD PROMO: (March 29, 2016-April 15, 2016)

Php100.00 discount to all categories

Post-race Inclusions:

5K and 10K

- FFR2016 Goodies/ Loot Bag and Drinks

- Finishers Medal for ALL 5K and 10K Participants

- FFR2016 Finisher Shirt for top Finisher of 5K and 10K Participants (Top 100 male and female)

21K - FFR2016 Goodies/ Loot Bag and Drinks

- FFR2016 Trophy/ Plaque for ALL Finisher

- FFR2016 Finisher Shirt for ALL Finishers

REGISTRATION TYPE & SITES:

Online Registration

http://www.goorahna.com/

In-Store Registration (March 29, 2016-May 28, 2016)

1. Juego Trinoma

3/F Trinoma Mall,

EDSA corner North Avenue

Quezon City

+63 (2) 9018985

2. Juego SM North EDSA

3rd Level, SM City North EDSA Annex

North Avenue corner EDSA

Quezon City

+63 (2) 7205035

3. Juego Greenbelt 4

2nd Level, Greenbelt 4

Makati Avenue corner Dela Rosa St.

Ayala Center, Makati City

+63 (2) 7575881

4. Juego Market Market

4th Level, Market! Market!

26th St. Corner C5

Bonifacio Global City, Taguig

+63 (2) 7922180

5. Yonex Mega Mall

3rd Level. Bldg. A SM Megamall

EDSA corner Julia Vargas Ave.

Mandaluyong City

+63 (2) 9147430

6. LiNing MOA

2/F South Entertainment Mall

Mall of Asia

7. Juego Alabang Town Center

3/F Alabang Town Center

Muntinlupa City

8. 100 Miles Café in BGC

Second Floor, Fort Pointe

Bonifacio Global City, Taguig City

+63 (2) 8086001

RACE SINGLET:

FINISHER MEDAL & PLAQUE:

FINISHER SHIRT:

For 21KM Finisher

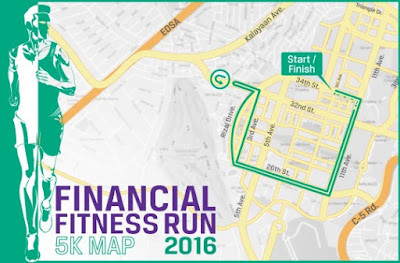

RACE MAP:

RACE RESULTS:

Race results will be available within three (3) days after the race atwww.myrunti.me

POWERED BY:

I AM PART OF FINANCIAL FIT COUNTRY!

Let's run guys and be aware to have a financial fit country

Team Run Direction Supports CFA-FFR2016

SO WHAT ARE YOU WAITING FOR SAVE THE DATE AND REGISTER NOW : )

No comments:

Post a Comment